Tape / DOM / Footprint Course: Opening Action Lesson VII

October 31, S&P500 (ES)

Each week I review key moments from recent price action in the indices. These instances will be analyzed using three methods: the tape / DOM; footprint; and candle chart. Synthesizing the three allows an understanding greater than the sum of its parts, leading to a complete understanding of the auction process. While there are many great resources out there, I am not aware of any that provide such a comprehensive study guide.

If you don’t have or use all of these tools, that’s OK. They represent the same concepts in different forms, and I close out each review with a candle chart.

Moreover, these studies review the most recent price action - with the week still fresh in your mind this provides another key layer of understanding: context! What data was issued, and how did that affect volatility? What was the market mood during the week? Where there any geopolitical events affecting sentiment?

Furthermore, I group analysis in a few broad categories, for example look above / below and fails (LAF, LBF - see here for the mechanics of the setup), mid-morning reversals and their sister late day fades, crowded trade fails, or opening action. These lessons ultimately create a library of different market concepts. This is a powerful tool to accelerate your understanding of the auction process.

There are no substitutes or shortcuts for hard work and discipline, but the material I share here is the closest head start you may find in your journey to successful trading.

Week of Oct 31 Context

Until the 31st, the week was spent in a continuation of balance from the prior week. Two clues on Wednesday suggested weakness, one of which was the weak high that I called out in my regular postings. The second was a weak close at the day’s low. This wrapped up an effective rejection of the top descending rail on a daily chart.

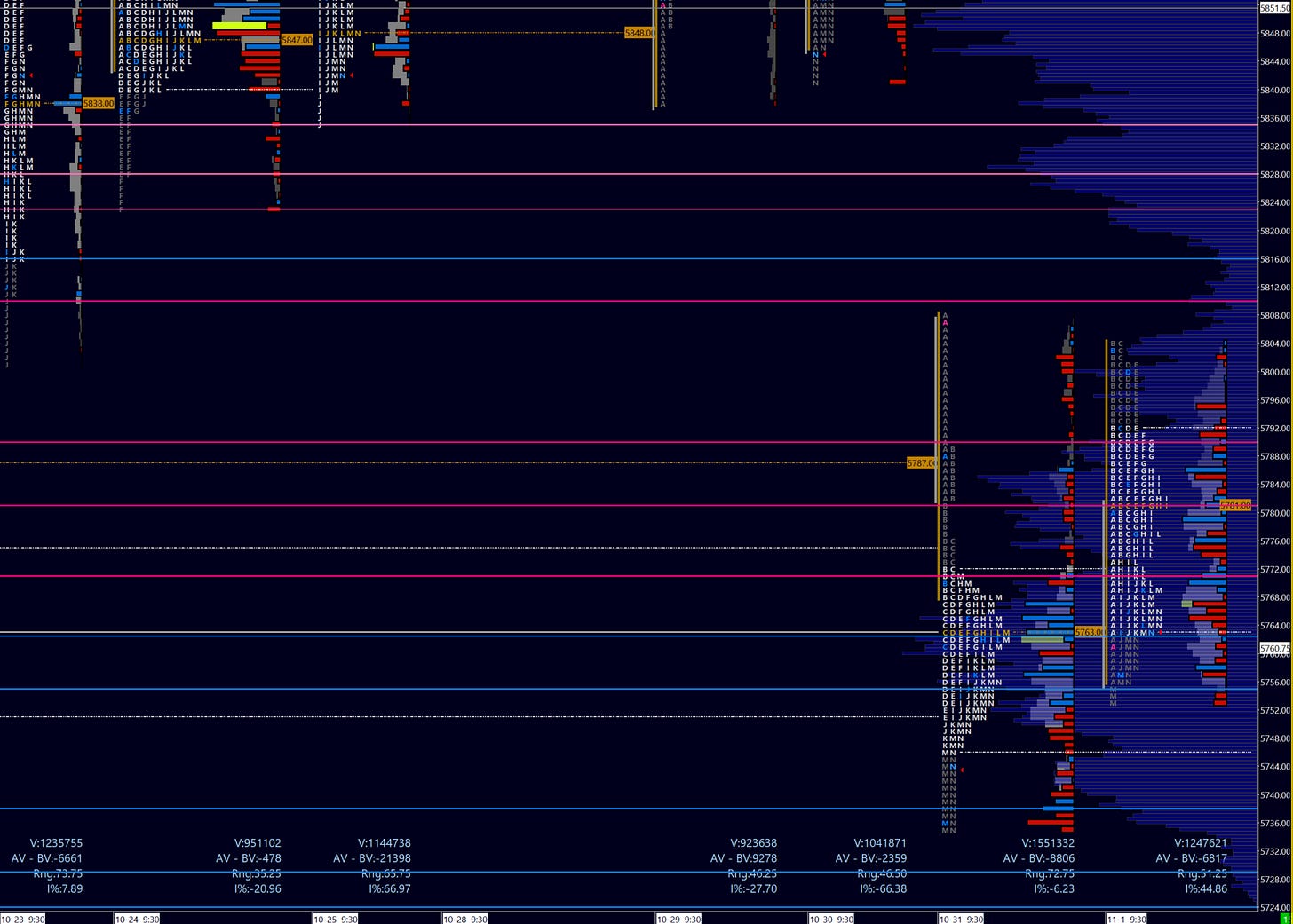

Image 1. ES daily TPOs

The weakness resulted in a gap open of 40+ points to the downside on Thursday. This is why clues in context are always important to take into consideration - trade does not occur in a vacuum. Sessions are neither linear as imbalances (to balance) are fundamentally the nature of markets.

In this case, gap rules applied. A fill of the gap and continuation into the prior day’s value suggests strength (in this case buyer strength), while the failure to make and maintain progress into the gap typically results in continuation in the direction of the gap.

At the following open, look for early confirmation of further weakness as we open on the gap down, looking for potential entries to the short side, either leaning against prior structural levels like a buying tail or balance low from below, the open, or the opening range mid, for some examples.

Analysis of Opening Action Tape/DOM

I consider the opening action the opening range (OR) or first the 30 minutes of action. I understand that definitions have changed over time, but unless I specify otherwise, I maintain the classic market profile definition of the OR. Remember to observe and understand the concepts the price action (absorption, exhaustion, counter-initiation) before jumping into a trade.

Refer to prior lessons for further study.

Video 1. ES tape / DOM / footprint; 5m candles; 9h34 - 9:45EST 4x speed

Before you continue, always ‘look left’. Note the mini-balance just ahead of the open, with a break in the 5m candle before the bell. We are effectively opening at the overnight low.

Strong seller aggression at the opening candle, note the heavy red prints in the footprint and accelerating selling delta. There is some ‘b’ shape to the candle volume profile, but this is overwhelmed by the speed of red prints on the tape.

9h35:00. Now the opening of the second 5m candle sees some responsive bid as the perceived dip is being bought. This is further seen in the blue prints on the tape into the offer. However note the swift push by sellers around 9h35:30 - indicating the presence of aggressive sellers into the bid.

9h36:20. Although the delta prints in the candle are turning darker blue, note the lack of progress as price has stalled. What you are seeing is absorption of buyers into the offer. Large passive sellers are potentially distributing inventory. This thesis might be invalidated IF buyers were to [quickly] trade through the open.