Setup Guide: Look Above / Below and Fail

Part I Conditions and Rules

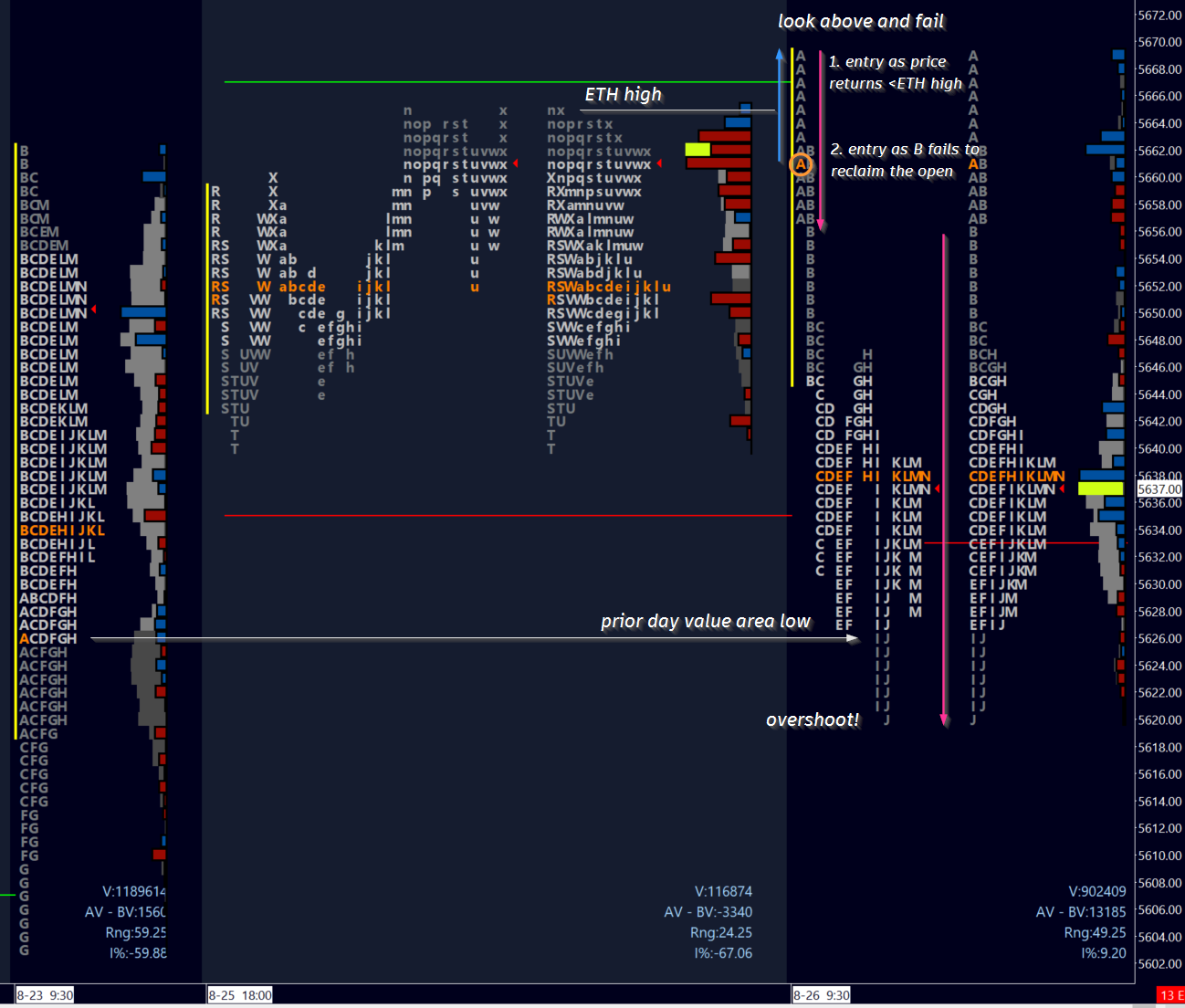

Image 1. ES TPOs, August 23 RTH to August 26 RTH

This is the introduction to one of my three key intraday setups in 2024, the Look Above and Fail (LAF) and the sister Look Below and Fail (LBF). Each of these following setup guides will be broken up in installments covering three aspects:

Examples with Conditions and Rules

Theoretical Analysis and Trade Execution

Running statistics and Application

What is a LAF/LBF?

The following examples cover the key conditions for the LAF/LBF setup from which we can establish conditions for entry. Exits are more dynamic, contingent on market conditions like volatility and structure. This is why it is paramount to prepare a plan each day with which to define risk, gauge exit targets, support, and resistance. I share free plans daily on my feed to at least get you started.

This is not a daily setup but it is frequent enough to be profitable; patience and the right conditions are required. Even when conditions are almost met, some days are simply less favorable, for example a large gap down/gap up, or event days like CPI. Regardless the same parameters always apply.

I will primarily examine the market action below in time price opportunities (TPO). Don’t worry if you aren’t familiar with these charts (they are easy to set up on most platforms however), we will also look at 30m candle charts side by side, although feel free to pull up a 5m as well if you like.

Finally, the goal of the following examples is not to analyze the price action, simply to show the conditions required for the setup.

Examples Ia. and Ib. August 26-27 LAF and LBF sisters

Image 2. Click to enlarge. ES TPOs, August 26-27