Image 1. This time is different

Well I was wrong!

The Nasdaq has already posted fresh highs, with the S&P on the cusp as of writing. A month ago I wrote that I didn’t see the case for new all-time highs, but one world war later, here we are.

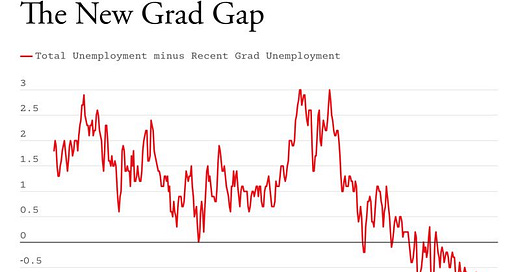

And as I mentioned last week, the tell may have been new highs in bitcoin - liquidity is still very much alive and pumping in the system. While the macro picture is deteriorating: see above graph, as the unemployment rate of recent grads is higher than the general population.

Simply trade the price action.

Reverend Bird’s Missal

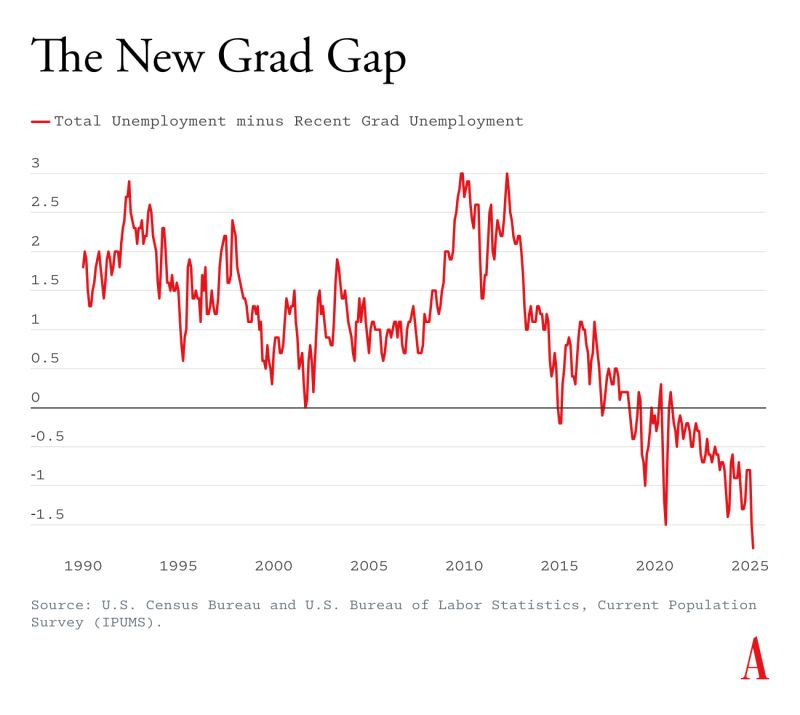

Volume is very thin at these levels, with an accumulation of gaps and poor structure below in a tepid trading environment. If and when the market turns, this may be a recipe for a fast inventory correction. We are not here to predict tops however.

Image 2. ES ETH and RTH as of 7h15EST

As we grind higher, bulls are primarily focused on the 6180 March contract high, coinciding with a new SPX high - with 6200 above. These levels may see responsive selling activity.

Bears are being continually ground up - this is extremely dangerous price action to fade, and it is best to wait for a blow-off top, or a strong sell and a retest of balance below to enter short. You can clearly see this churn in the daily chart below.

Image 3. ES 30m chart and structural levels

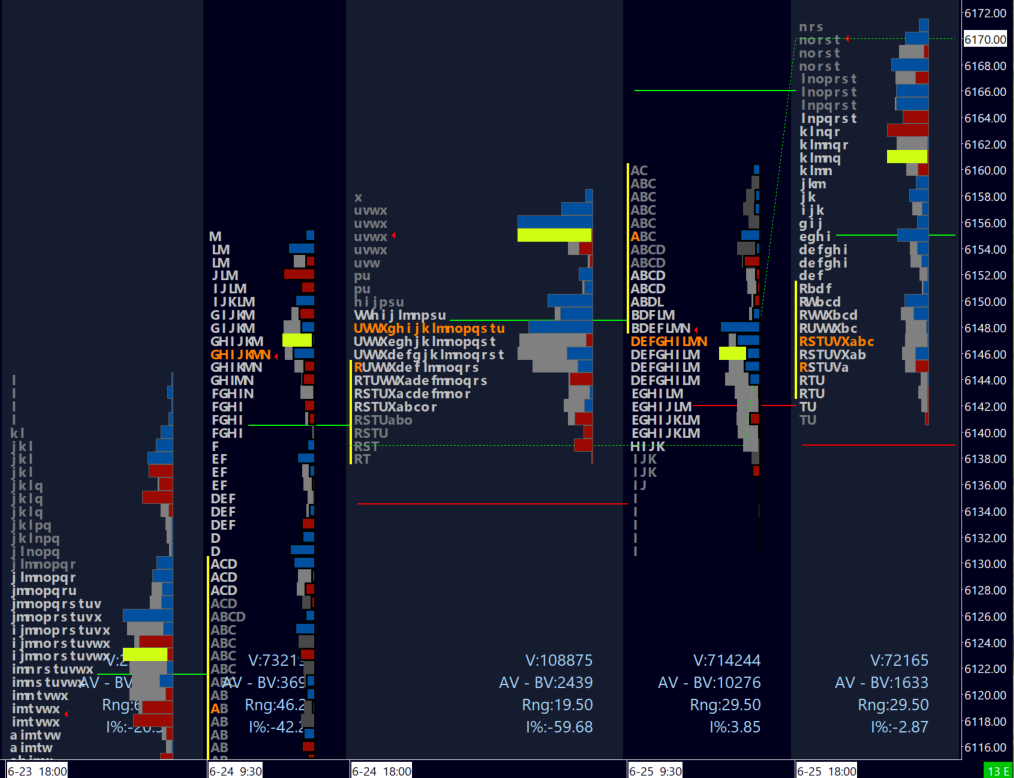

Crow’s Nest: Thursday June 25

Monday pivot 6150. An early bid at 6155 leans long. GDP (and unemployment) numbers at 8h30EST can shake things up, especially if the macro is deteriorating as I project.

a) Defense of pivot and minimal time below 6143 targets 6168 / ONH, a break above looks to trade 6180 / ATH. Further above are 6192, 6202, with 6220-25 at an extreme.

b) Defense of pivot and momentum below 6143 targets 6135 and a break of daily OTFU to 6125. Further below is 6113 and 6103, with extreme targets 6092 and gap fill 6081.

c) VIX pivot 16.95. Sellers may be encouraged with the VIX over 17.20 19.15, with further buyer support below 16.50

Keep it simple, and don’t be a bird(fog)brain!

I regularly post individual ticker levels and analysis on my X (Twitter) feed. Feel free to request your favorite tickers from your favorite crow in the comments below or Twitter.

Enjoying my film picks, analysis, and market plans? Send your appreciation to my Tip jar:

This journal remains free, but you can support my work by liking and commenting (including what you’d like to see more of!), and most of all by sharing my work with folks you know or on Twitter. Your support is hugely appreciated and helps keep my publication ongoing and timely! Be sure to follow me @rareverend on X (Twitter) for the latest updates.

Don’t maintain bias in the face of contradicting information! Capital preservation is key.

This is not investment advice as I am not a qualified licensed investment advisor. All information, opinions, commentaries, and suggestions, expressed or implied herein, are for entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. I will not and cannot be held liable for actions you take as a result of anything you read here. As always, conduct your own due diligence, or consult a licensed financial advisor or broker before making investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise.