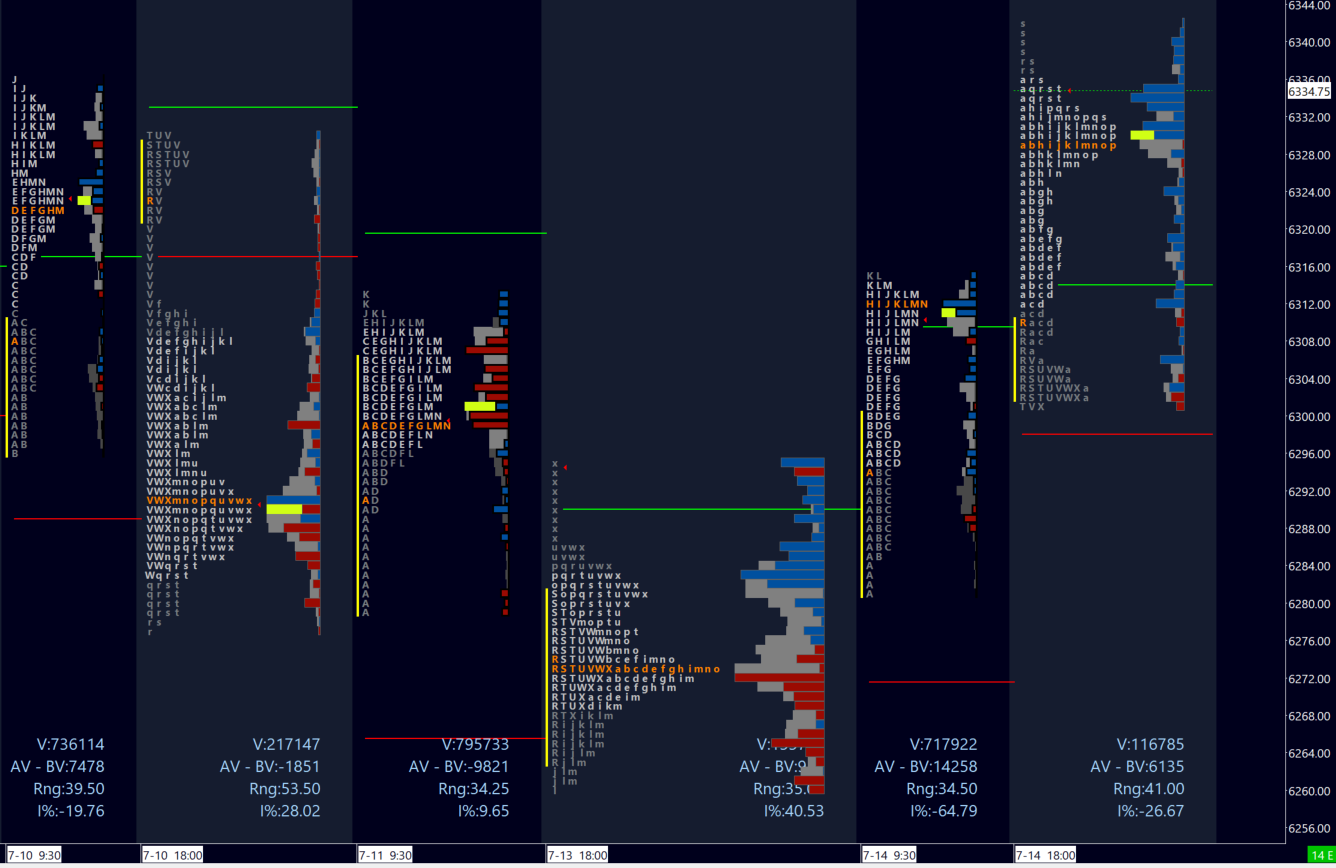

Image 1. Clown world data release

We are in a larger seven-day balance area with a POC of 6307 and an important low volume node (LVN) at 6315. I’ll be using the latter as the day’s pivot - coinciding with the prior day high and a point away from its VAH.

Reverend Bird’s Missal

The overnight trade is net long as of writing, although CPI released at 8h30EST could change that if the data comes in soft. In case of a gap open - gap rules apply. If the gap holds on an open-drive or retest, generally trade in the direction of the gap, especially on a break of balance.

Acceptance within the prior day value can see price trade in that direction, targeting the prior day POC, VAL, and potentially daily low.

Image 2. ES ETH and RTH profiles as of 7h00EST

Bulls sustaining above 6330 have major target 6350 above, followed by 6357 - a zone where longer-term sellers may be encountered.

Image 3. ES 4h chart and structural levels

Crow’s Nest: Tuesday July 15

Tuesday pivot 6315 - Below 6310 leans short, above 6325 long.

a) A hold of a gap / pivot and time above 6325 targets 6339 and 6349-57. Momentum above then targets 6368 and 6380, with extreme target 6391.

b) Acceptance of prior day value targets 6300 - where buyers may defend. Further below are 6291, and 6279, with an extreme at 6265.

c) VIX pivot 16.55. Possible continued selling above 16.35 while buying may be supported above 17.00.

Keep it simple, and don’t be a birdbrain!

I regularly post individual ticker levels and analysis on my X (Twitter) feed. Feel free to request your favorite tickers from your favorite crow in the comments below or Twitter.

Enjoying my film picks, analysis, and market plans? Send your appreciation to my Tip jar:

This journal remains free, but you can support my work by liking and commenting (including what you’d like to see more of!), and most of all by sharing my work with folks you know or on Twitter. Your support is hugely appreciated and helps keep my publication ongoing and timely! Be sure to follow me @rareverend on X (Twitter) for the latest updates.

Don’t maintain bias in the face of contradicting information! Capital preservation is key.

This is not investment advice as I am not a qualified licensed investment advisor. All information, opinions, commentaries, and suggestions, expressed or implied herein, are for entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. I will not and cannot be held liable for actions you take as a result of anything you read here. As always, conduct your own due diligence, or consult a licensed financial advisor or broker before making investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise.

what was important about 6291 for u? thanks

6358 is 2.0 fib of the CPI candle reaction (first two min) so that aligns