Image 1. The three-body problem solved

A subscriber recently asked about the role of liquidity in the markets - that’s an extremely broad question but it fits in with themes in the macro note we’ve been researching here at the Crowstack. So I’ve reconfigured the quarterly macro note by zooming out much more than originally intended, examining the thesis: are markets fundamentally rigged through volatility suppression?

We’ll break the macro note into installments, coming back around to investing themes into the US mid-terms and beyond. This first part is a brief survey of liquidity. Which I think is apt, as macroeconomics is increasingly disconnected from equity performance. Starkly noticeable in my lifetime of work and participation in the markets.

Until the current regime becomes so unwieldly that it forces its own collapse, markets may well be so dialed in so that a 50% fall in equities is a relic of the past. What we saw earlier this year in the “Great TACO Rebound” - Trump Always Chickens Out - is potentially a reset button that preserves the current system by controlled demolition of weak positions.

Much like the 2020 Covid Crash.

Mechanisms that were set up in 2008 (this was my role at the time in conjunction with commercial banks, the Treasury, and European partners) are permanent features, they kick in as a cascade risk becomes unmanageable. It’s a great way to snap up cheap assets, too. The latest tool is perhaps the most interesting, in President Trump’s social media account:

Image 2. Trump nailing the lows. S&P500

Not one to mince words.

Follow the Money

Liquidity IS the global system, both the fuel and the grease that keeps trade and economies running, and credit flowing. We’ll soon see how in recent decades, the fuel mixture has been tweaked, adding more fuel at the expense of grease, effectively ‘burning through’ any clog in the system! This has the primary effect of increasing asset prices, whether it be housing, equities, precious metals… even the cost of education (a pedigree as an ‘asset’!).

Obviously a massive wealth effect is a consequence - by design.

The liquidity landscape is dominated by a mix of public and private sources. Central bank balance sheets expanded dramatically post-2008 and again during COVID, with the Federal Reserve's balance sheet peaking around $9 trillion. Government deficit spending adds liquidity directly through Treasury issuance, while private credit creation occurs through commercial banking and shadow banking systems.

Private credit has shown resilience despite higher interest rates because of several structural factors. Credit demand remains strong from corporations refinancing at higher rates, private equity firms accessing direct lending markets, and alternative credit providers filling gaps in traditional banking. Private credit funds benefit, charging higher spreads as floating-rate structures protect against duration risk.

Liquidity Dynamics

Markets may no longer operate according to traditional economic principles - evidence suggests this is by design, not accident. Since 2008, a sophisticated liquidity management system emerged where the Treasury controls supply through bill/bond composition, the Fed manages demand via overnight facilities, and regulatory changes have domesticated previously chaotic offshore dollar markets.

The result is a "managed market" regime where equity returns doubled despite money velocity collapsing, creating unprecedented wealth concentration that severs the traditional relationship between economic activity and asset prices.

This analysis examines four key mechanisms - money velocity suppression, Treasury issuance strategy, Eurodollar domestication, and private credit expansion - that together explain how markets became disconnected from underlying economic fundamentals, why traditional monetary policy transmission broke down, and what new systemic risks this new architecture creates for both the financial system and the broader economy.

I. Money Velocity's Decline

The velocity of money has been in secular decline since the early 2000s, meaning each dollar circulates through the economy fewer times. This reflects increased savings rates, corporate cash hoarding, rising inequality (the wealthy have lower marginal propensities to spend), and financialization where money gets trapped in asset markets rather than flowing to productive uses.

Image 3. Money velocity and the S&P500 rate of change, yoy

This chart reveals some fascinating patterns!

The Great Divergence (2008-Present) Most striking is how money velocity entered structural decline post-2008 while equity markets experienced significant volatility and ultimately strong performance. This shows that traditional liquidity transmission mechanisms have fundamentally changed.

The "Liquidity Trap" Phenomenon The period from 2020-2023 is particularly interesting: despite historically low money velocity (indicating money wasn't circulating through the real economy), the S&P 500 posted exceptional returns. This suggests liquidity was increasingly channeled into financial assets rather than productive economic activity. The macro disconnect on full display!

Implications for Current Environment The recent modest velocity recovery (from 1.12 in 2021 to 1.35 in 2024) alongside continued strong equity performance might suggest we may be entering a phase of liquidity flowing back into the real economy while maintaining asset price support. However - we remain below 2015-2019 levels and this is largely a factor of a post-Covid shock returning to ‘normal’.

This divergence helps explain why traditional monetary policy became less predictable - central banks are operating in an environment where liquidity creation doesn't translate into economic velocity in the same way it historically did. Instead, much of that liquidity gets absorbed by financial markets, creating asset price inflation rather than broad-based economic activity.

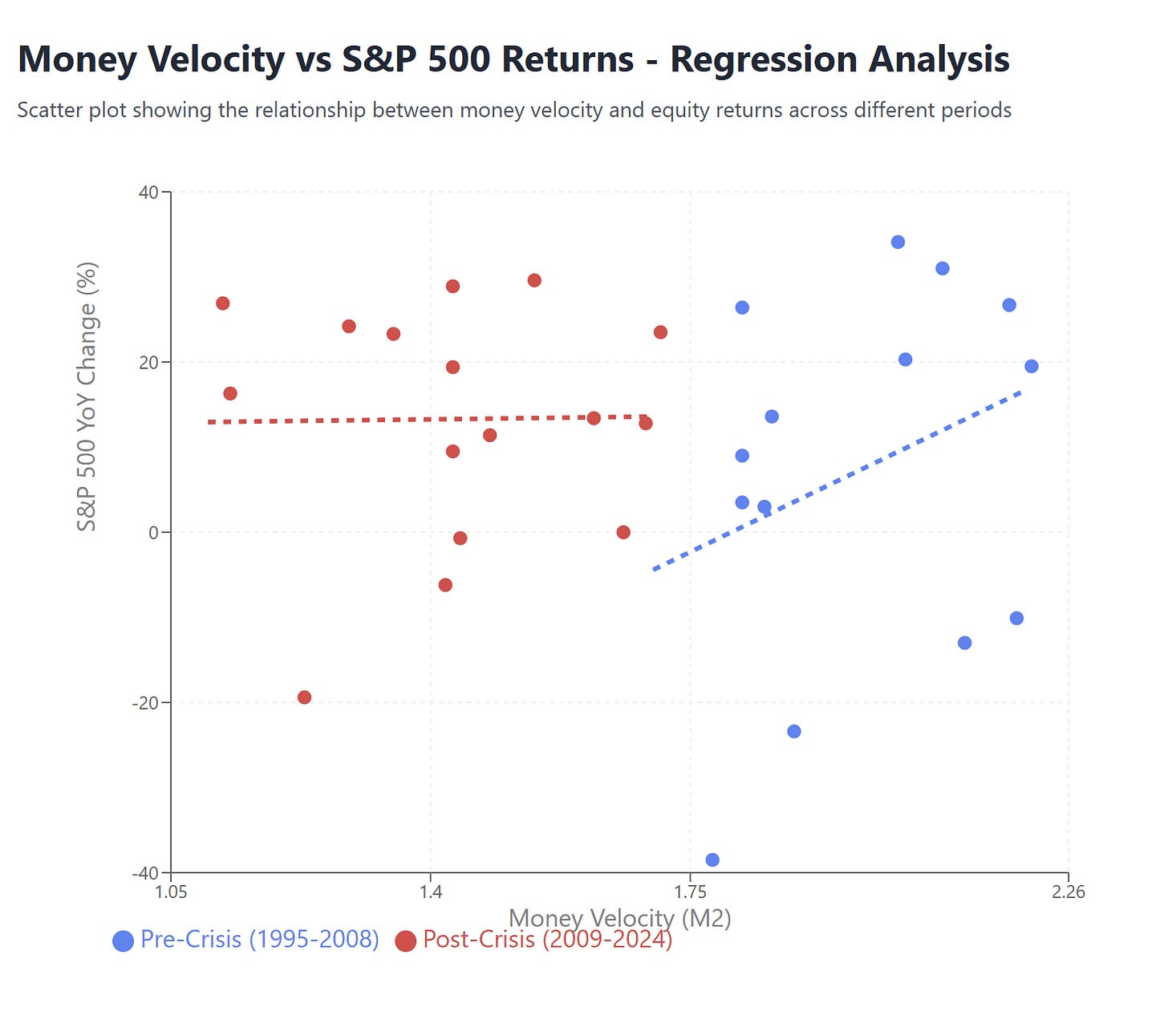

Image 4. A regression analysis. More stable markets - at what cost?

This data suggests central banks successfully created a "two-tier" system, once of financial markets with reduced risk and controlled volatility, and the other a real economy with increased instability and liquidity chaos

The blue dots (right side, pre-crisis) show a "natural" system where both velocity and returns fluctuated together. The red dots (left side, post-crisis) show an "artificial" system where markets are managed while the underlying economy becomes more volatile. This explains the persistent wealth inequality post-2008 - asset holders benefited from managed, low-volatility markets while the real economy experienced increased instability.

The “Great Paradox”: Higher Returns, Lower Velocity

Pre-Crisis (1995-2008): 7.3% average annual S&P 500 returns

Post-Crisis (2009-2024): 13.3% average annual S&P 500 returns

Despite money velocity collapsing by 27.4% (from 1.98x to 1.44x), equity returns nearly doubled in the post-crisis era!

The Breakdown of Traditional Relationships

The numbers tell a story of structural break: before 2008, money velocity explained nearly 10% of equity return variance, with higher economic activity paradoxically correlating with lower market performance - the hallmark of a functioning market economy.

After the crisis, that relationship vanished entirely. Returns now hover consistently between 12-14% regardless of how fast money circulates through the real economy, creating a flat regression line that screams "artificial intervention." Traditional liquidity circulation became completely irrelevant to equity performance - we're no longer operating in a market system where economic fundamentals drive asset prices, but rather a managed regime where financial markets float independently of the underlying economy.

Policy transmission mechanisms then had to fundamentally change to support the system - central bank liquidity injections flow directly to asset markets rather than through the broader economy!

Textbook evidence of financial repression - the post-2008 system created:

Managed Asset Markets: Central bank intervention (QE, forward guidance, "Fed put") successfully dampened equity volatility by providing predictable liquidity backstops

Chaotic Real Economy: While markets were stabilized, as a consequence the real economy (measured by velocity) became more volatile and unpredictable

The Great Decoupling: Financial markets were insulated from real economic volatility through direct central bank intervention

It’s NOT the Economy, Stupid

This data reveals the profound structural change in how liquidity flows through the economy. In the pre-crisis era, higher money velocity coincided with more modest equity returns, suggesting liquidity was distributed more broadly across the real economy.

In the post-crisis era, we see the opposite: liquidity became increasingly concentrated in financial markets rather than circulating through the broader economy. This "financialization" of liquidity explains why:

Asset prices inflated dramatically despite sluggish real economic activity

Wealth inequality accelerated as financial assets outperformed wages and business income

Monetary policy transmission changed - QE boosted asset prices more than economic growth

The "wealth effect" became dominant in economic transmission mechanisms

This pattern suggests we're operating in a fundamentally different liquidity regime where traditional relationships between money circulation and economic outcomes have been severed. The liquidity is there, but it's trapped in a financial circuit rather than flowing through the productive economy.

This helps explain why central banks have struggled with the effectiveness of traditional monetary policy tools in recent years, and may have given up entirely. To wrap up: market participants will be less likely to price the impact of macroeconomic data, and that works both ways.

Enter the reign of the Treasury!