Footprint Course: Identifying Opens

April 21-25, S&P500 (ES)

Each week I review key moments from recent price action in the indices. These instances will be analyzed using three methods: the tape / DOM; footprint; and candle chart. Synthesizing the three allows an understanding greater than the sum of its parts, leading to a complete understanding of the auction process. While there are many great resources out there, I am not aware of any that provide such a comprehensive study guide.

Image 1. Just an average market sell. The Course of Empire: Destruction, Thomas Cole (1836)

What’s in an Open?

Examples from the footprint charts. In this series we explore the three primary concepts revealed using this tool with regard to ‘turnarounds’ in the price action: absorption, exhaustion, and counter-initiation.

In these volatile market conditions, a clear edge is being able to identify the likely direction early on - at the end of initial balance (IB), or first 60 minutes after open, if not by the opening range (OR) - or 30 minutes in my bird book.

This will be a pure footprint course, looking at each open this past week!

These are flash cards below. To keep it simple, I will identify the three primary concepts of price action (letters), while describing clues contained within the footprint (boxed highlights) at each turn. By the time initiation rolls around, it should be clear which side of the trade you are more likely to come out ahead on.

And for the love of bird, don’t fight a trend.

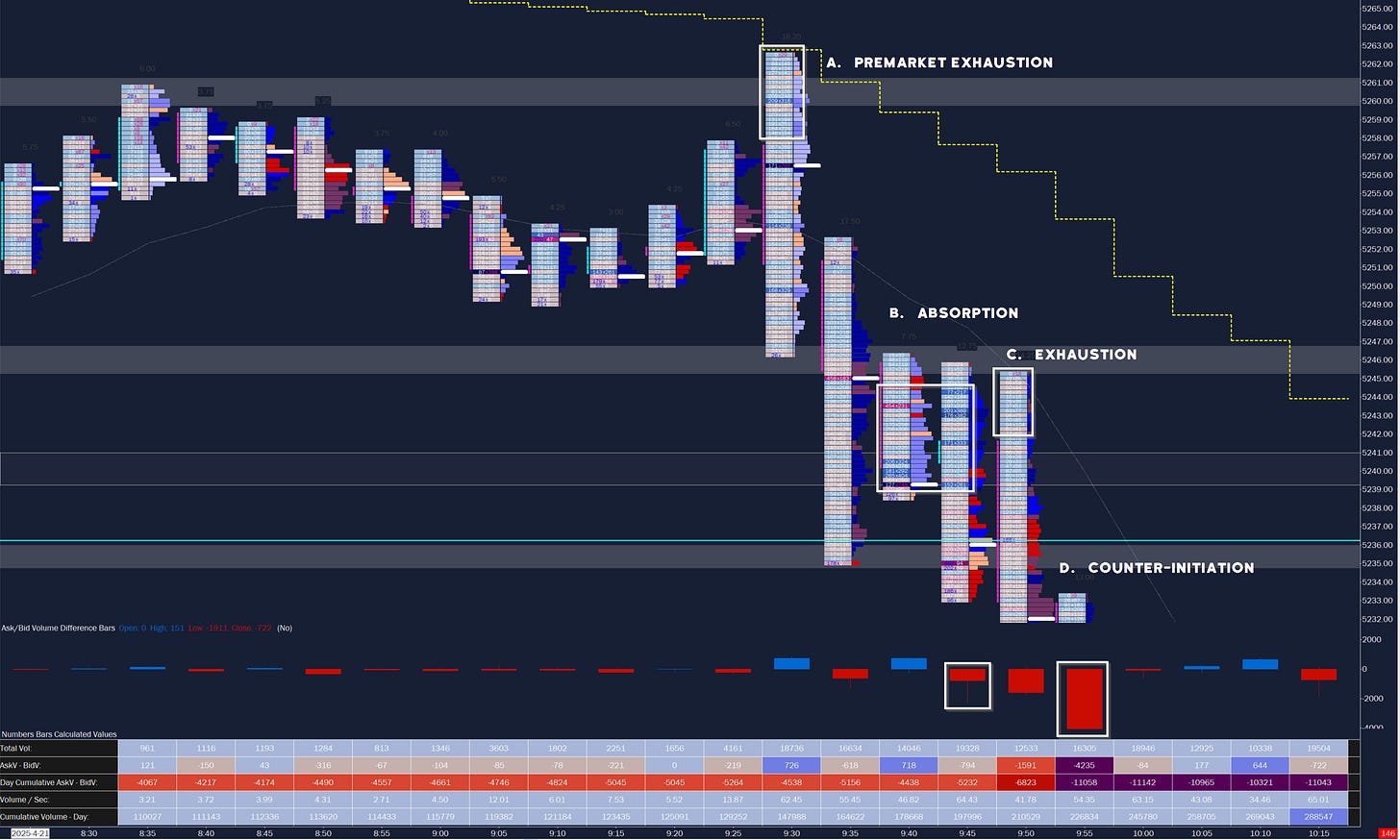

Image 2. ES 5m footprint, April 21

A. Note the lack of buyer interest at the VWAP (yellow dash) and general exhaustion as the 5m candle turned red.

B. Following the open, some dip buyers stepped in to bid the 5240s Note the heavy blues but general lack of upside! More worrisome is the 9h45 candle with a red delta bar below. Clearly sellers are present in volume.

C. A very weak attempt to move higher - note the total lack of heavy blues as buyers exhaust.

D. A close at the lows of the candle followed by heavy sell volume send prices lower. Remember, psych numbers (like 5200) are good targets! This can be a solid ‘look above and fail’ day.

Image 3. ES 5m footprint, April 22

A. Note the aggressive pre-market bid ahead of the open - heavy blue deltas. These are important clues to take into context - are buyers still active and confident into the bell? Then we look for either a) sellers throwing in the towel early at open after a possible inventory correction; b) an open-drive: buyers continue the aggressive bid through the OR.

B. Inventory correction at the open! This takes place about 70% of the time on net long or net short ETH trade. Buyers step in at the grey liquidity band identified ahead of open. Selling is already weak to begin with - note the light selling delta bar below at the 9h30 mark. Meaning any (weak) selling is absorbed.

C. A break of the opening level sees the 9h45 candle retest the opening candle, one tick off. Sellers effectively gave up. This is possibly setting up to be an open-drive day, typically a day with single prints and/or a ‘p’ (or in the case of selling, ‘b’) shaped profile.

D. A strong bid above the overnight highs (ONH) shows a strong buyer hand as buyers initiate to the upside. Note the large buying delta bar below.

Let’s look at the remaining examples, in addition to an A+ trade setup on Wednesday!