Feb 15, ES Plan and Missal: Checkmate

The best moves are unconventional.

Image 1. Sometimes you sacrifice for the initiative. Mikhail Tal, 1976

Chess is virtually unsolvable. Some of the strongest modern chess engines have been applied to it and the game remains unsolvable. Its current iteration has been around since roughly the 14th c., coincidentally a century before the Amsterdam commodities bourse was opened.

I pay homage here to Mikhail Tal, a Latvian-Soviet master of the game. His often unconventional and consistently daring style had the world’s champions on the backfoot. He was not shy to sacrifice some of his best pieces in devising sacs of great cunning. His opponents moves were not only calculated far in advance but also set up in such a way that the adversary’s estimated perceived lower risk would ultimately beget the riskiest move. I’ll perhaps sum it best in his own words, “You must take your opponent into a deep dark forest where 2+2=5, and the path leading out is only wide enough for one.”

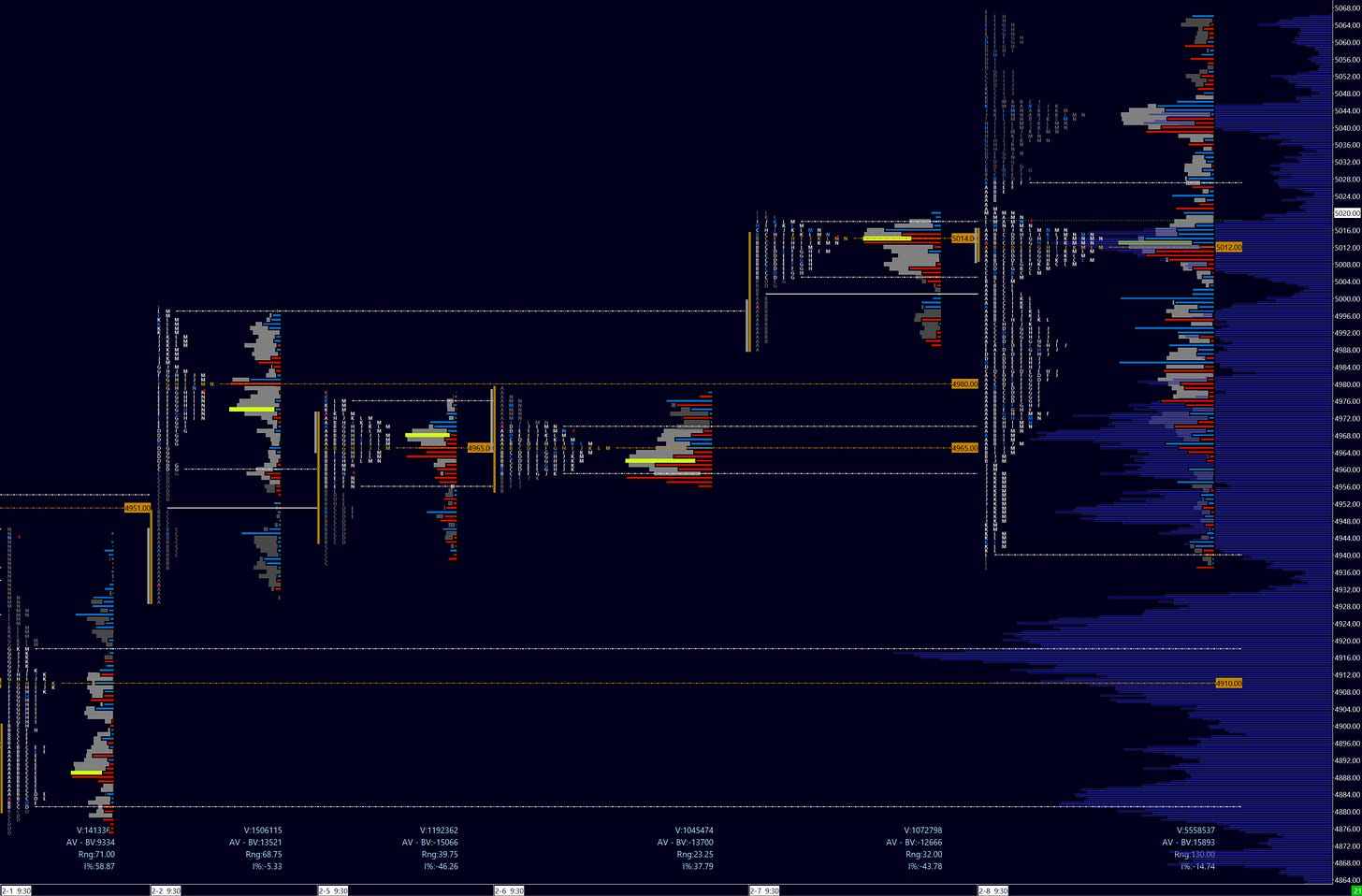

Many traders may feel similarly about the market on most days, but perhaps especially so on Wednesday’s seemingly frustrating auction. I subtitled yesterday’s Missal “[the] brutal lover 5,000.” Indeed this was a sobering day for both longs and shorts around this level. While our pivot 4983 played out well, perfectly supporting tests on three separate occasions, ES managed to close above short term value (5014) at 5015.

I don’t think we are done with 5,000 just yet.

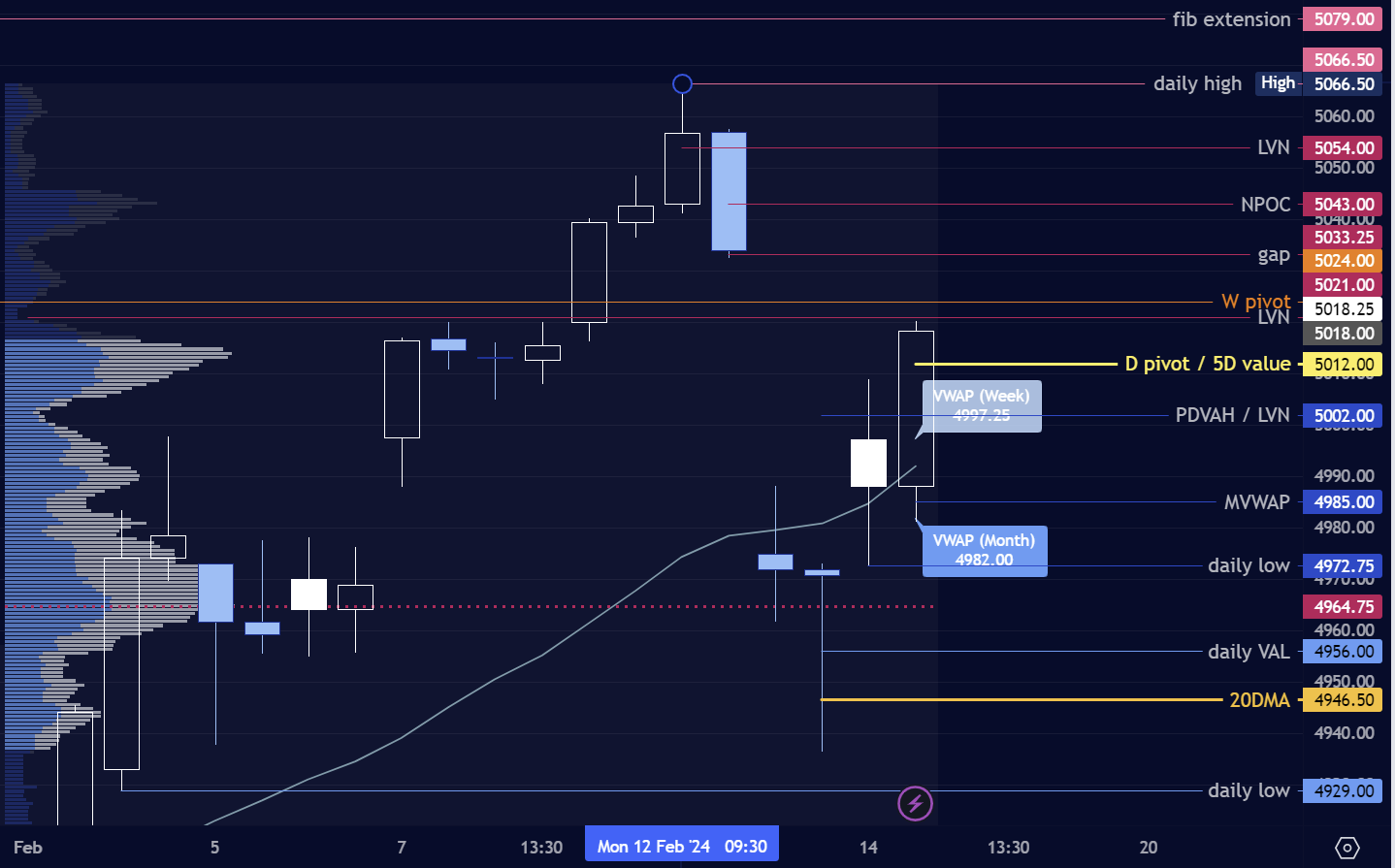

Image 2. ES current short-term (5D) and daily profiles

Minister’s Missal

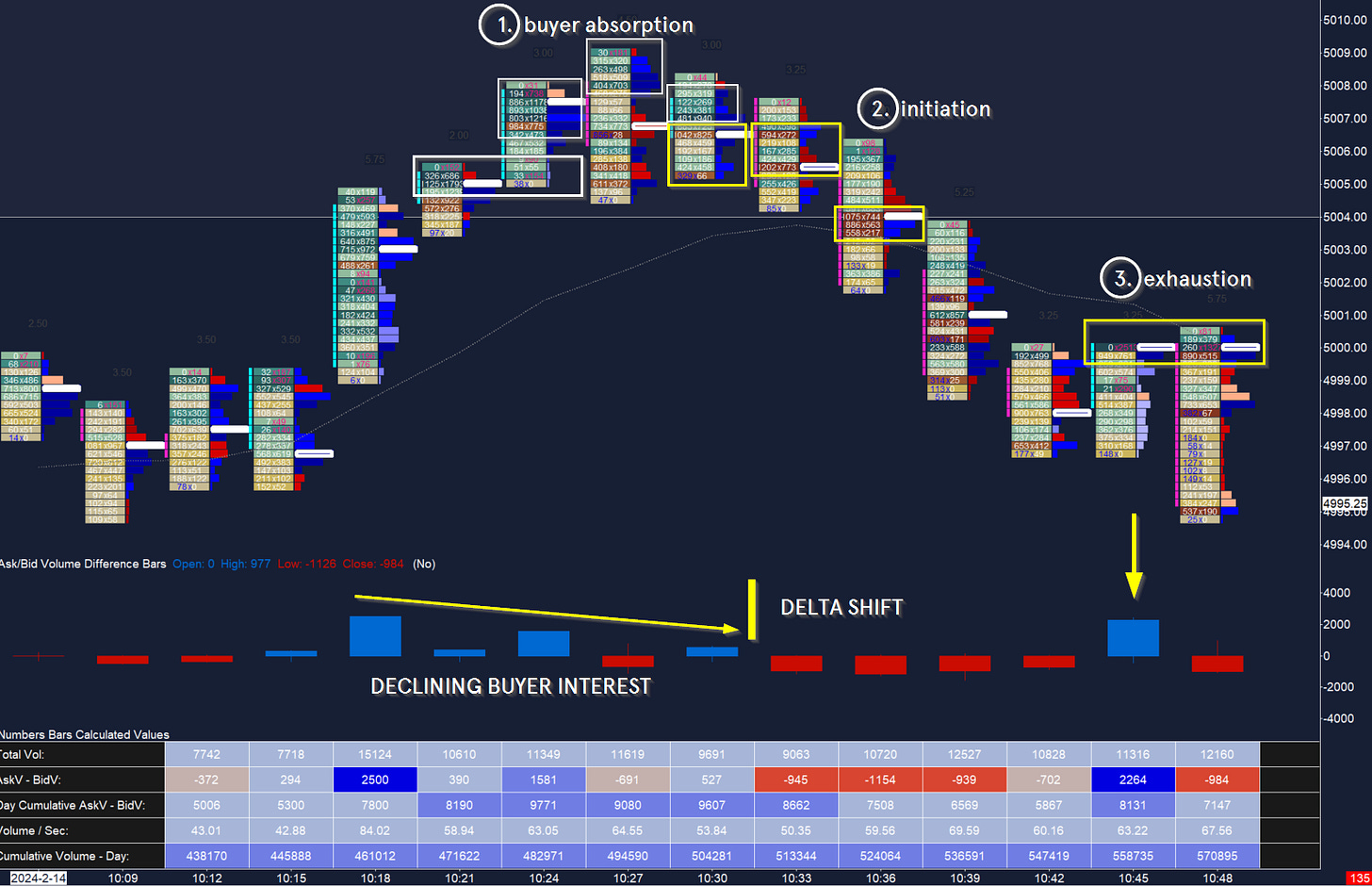

Following a breakout in globex during the European open, prices managed to climb into 5,000 just ahead of a (gap) open. Buyers pushed above the ONH but this manifested as a ‘look above and fail’ (LAF), where sellers then came in to fill the gap. A lack of acceptance below the PDH saw a bid step up once more - this time into a naked value area low. These types of levels I usually do not scrutinize, but as I mentioned on my feed in a market of extremely short-term traders these exacting references can be common.

Image 3. Footprint analysis of Wednesday IB high

The rejection here then led to the first push into my pivot 4983 (one of four on the day!). After some initial support, sellers managed to initiate below the pivot and into the PDPOC however this was quickly bought up. By now a bullish lean to the day was becoming apparent.

On two more occasions, sellers attempted to return to the PDVA. However note that aside from H period, and just barely), no period was able to close within the PD range. This was a critical piece of information to switch long if you were coming into the session short. Indeed the L period saw a break of the day’s B and C period weak high, with M period pushing to close the day above short-term value. Indeed, the HOD was two ticks from my final target for the day, 5021.

Image 3. Friendly reminder. Wednesday plan

A victory for the buyers.

But is it?

Image 4a. Footprint analysis at Wednesday’s lows

Image 4b. Candle chart analysis at the Wednesday’s lows

The day was a balanced session with a strong buying tail below 4982. This session did good work in partially filling out the gap from CPI, but 5033.25 remains above for a full gap fill. Buyers are not in the clear until this gap is closed - and 5035 is potentially reclaimed on a daily close. Heading into tomorrow I think the 5012 short-term value level will play a critical role; time spent on either side will likely decide the direction of close for the week.

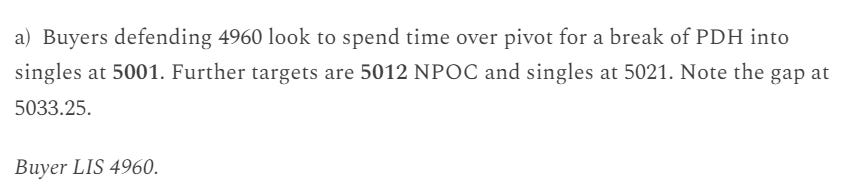

Thursday Plan and Levels

Pivot 5012. Buyers now have a gap above to close. Sellers aim to return back under 4997 to open tests of auctions below. I am expecting a 35 point range with possible 10 overshoot.

a) Buyers defending 5003 (LVN and M period base) look to make progress above 5021, where longer-term sellers may step in up to the gap close at 5033.25. Momentum above this can see NPOC 5043 and LVN 5054 above.

Buyer LIS 4982.

b) Sellers need to defend 5021 early on and target an hourly close below 4997, negating Wednesday’s afternoon breakout. A break of PDPOC 4990 could revisit 4982. Liquidation may target 4972, LVN 4961.

Recall further levels 4946, daily low 4937, and 4929.

c) The VIX below 14.10 will support pushes to the upside, while prints over 15.40 support selling. TSLA can stay bid over 188. Finally, AAPL over 184.50 and NVDA breaking 743 can support the indices. Consider 17815 the NQ pivot.

Image 5. 4H TF, Critical ES levels

Tip jar - support my continued work!

Your support is appreciated and helps keep my publication going. I do my best to respond to everyone in a timely way.

Be sure to follow me @rareverend on X (Twitter) for the latest updates!

Don’t maintain bias in the face of contradicting information! Capital preservation is key.

This is CERTAINLY not investment advice and I am not a qualified licensed investment advisor nor a minister of the church. All information found here, including any opinions, commentaries, jokes, outright mistakes, and suggestions - expressed or implied herein - are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be as accurate a picture of trade as I see it, it is after all how I see it and errors or inaccuracies are practically expected. I will not and cannot be held liable for any actions you take as a result of anything you read here. As always, conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise.