Crow Calls: Week of Nov 3

Options Tickers

Image 1. Crow Calls

Weekly Crow Calls

Back to a regular series following some personal events this summer. I intend to resume posting weekly or every other week, depending on setups. I am indebted to my readers and your patience in what has been a difficult year.

As a rule, I lean to highly liquid options (e.g. TSLA, NVDA), however if a setup presents itself, I will try to find the highest liquidity strikes in otherwise low-vol names.

Telsa (TSLA)

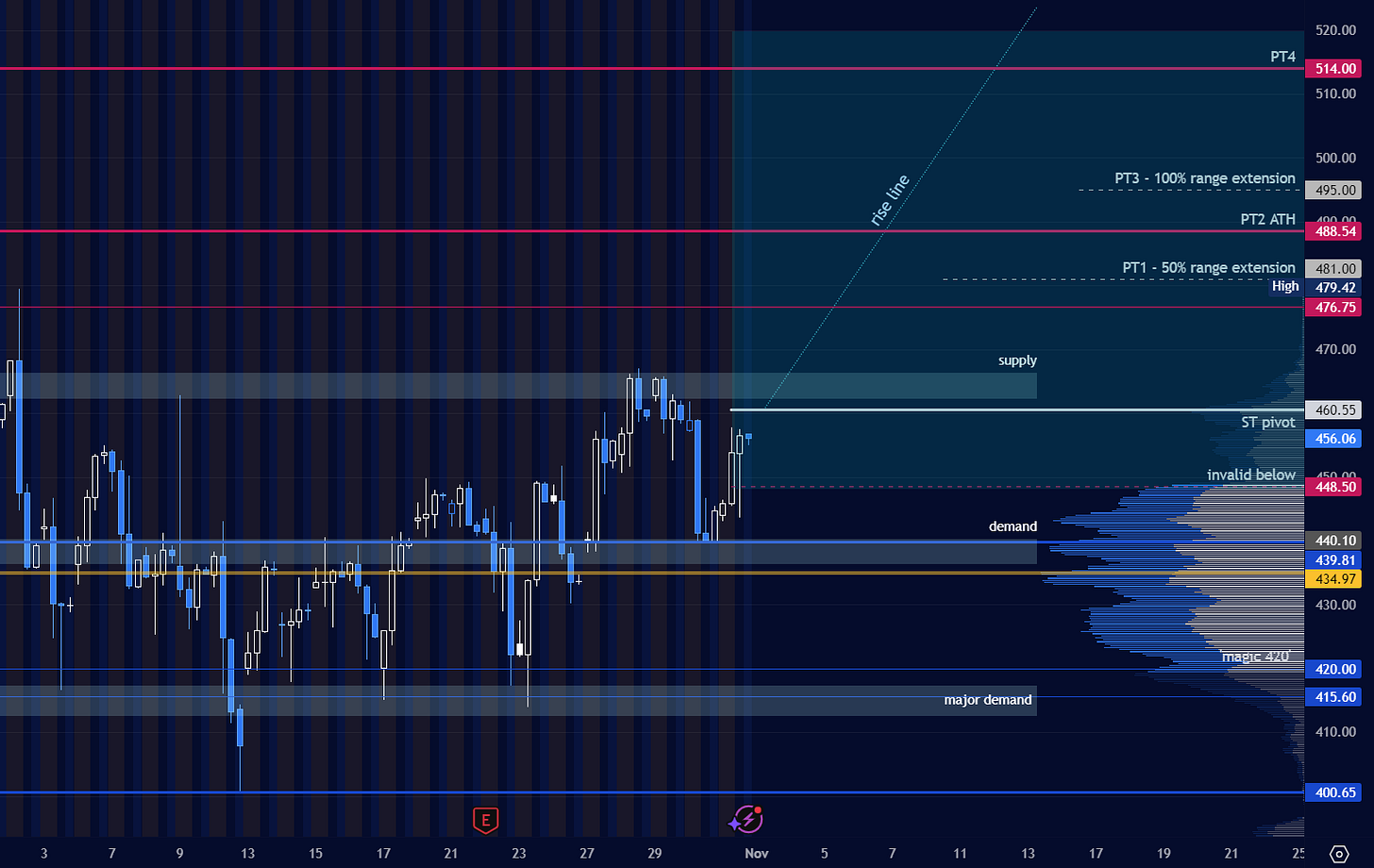

This is beginning to form a cup and handle on a 4H timeframe. With a clear short-term pivot, stop, and targets, it’s an interesting setup for testing 500 in the near future. It’s an expensive play, however - it’s a liquid ticker but best suited for larger accounts.

Image 2. TSLA 4H chart and option play area

Aggressive:

Nov 7 500c at 2.80

Conservative

Nov 14 500c at 6.70

We have more interesting tickers below: